oregon tax payment due date

Pay in Full - Pay in full by November. Please see Form OR-65 Instructions for due dates for non-calendar-year filers.

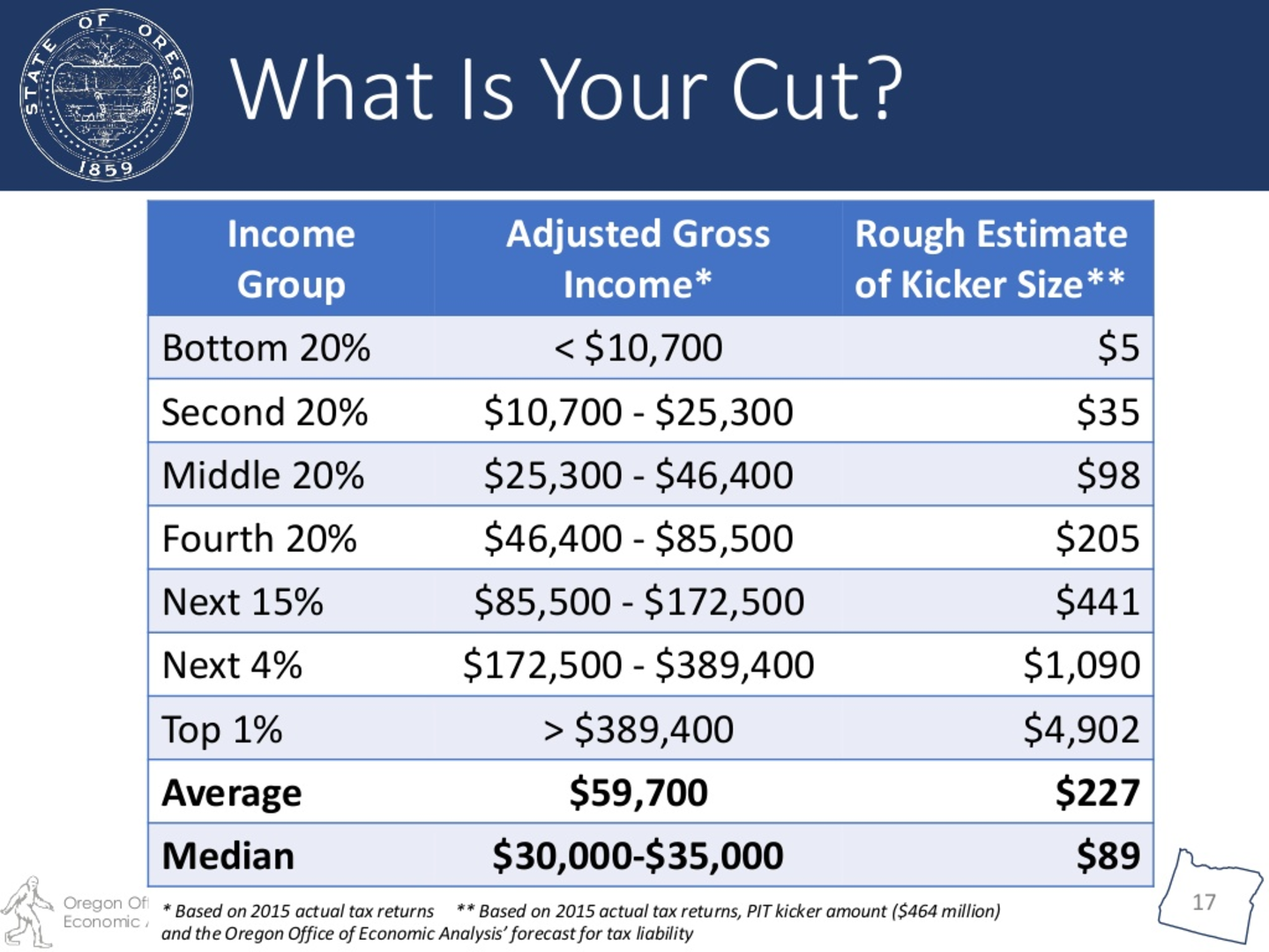

Oregon 2021 Tax Surplus Kicker How Much You Ll Get When To Expect It

Due dates for individuals March 15 2022 Partnership returns.

. Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules. The final 13 payment is due by May 15th. Oregon Department of Revenue PO Box 14003 Salem OR 97309-2502 Tobacco and Cigarette Taxes Electronic payment using Revenue Online.

Quarterly Use Fuel Seller and User Tax Reports must be received by the department on or before the due dates according to the following schedule. Under the authority of ORS 305157 the director of the Department of Revenue has ordered an automatic extension of the Amusement Device Tax due date to April 14 2021. However Senate Bill SB 1524 signed into law at the end of March 2022 now requires pass-through entities to pay estimated taxes for the Oregon PTE-E beginning June 15.

If you need assistance with the preparation of your return visit the. Oregon Estimated Tax Payment Due Dates 2022. Quarter Period Covered Due Date 1st 1-1 to.

Oregon will require 2020 first quarter estimated tax payments to be made on April 15 2020. Select a tax or fee type to view payment options. Tax Office Tax Payments.

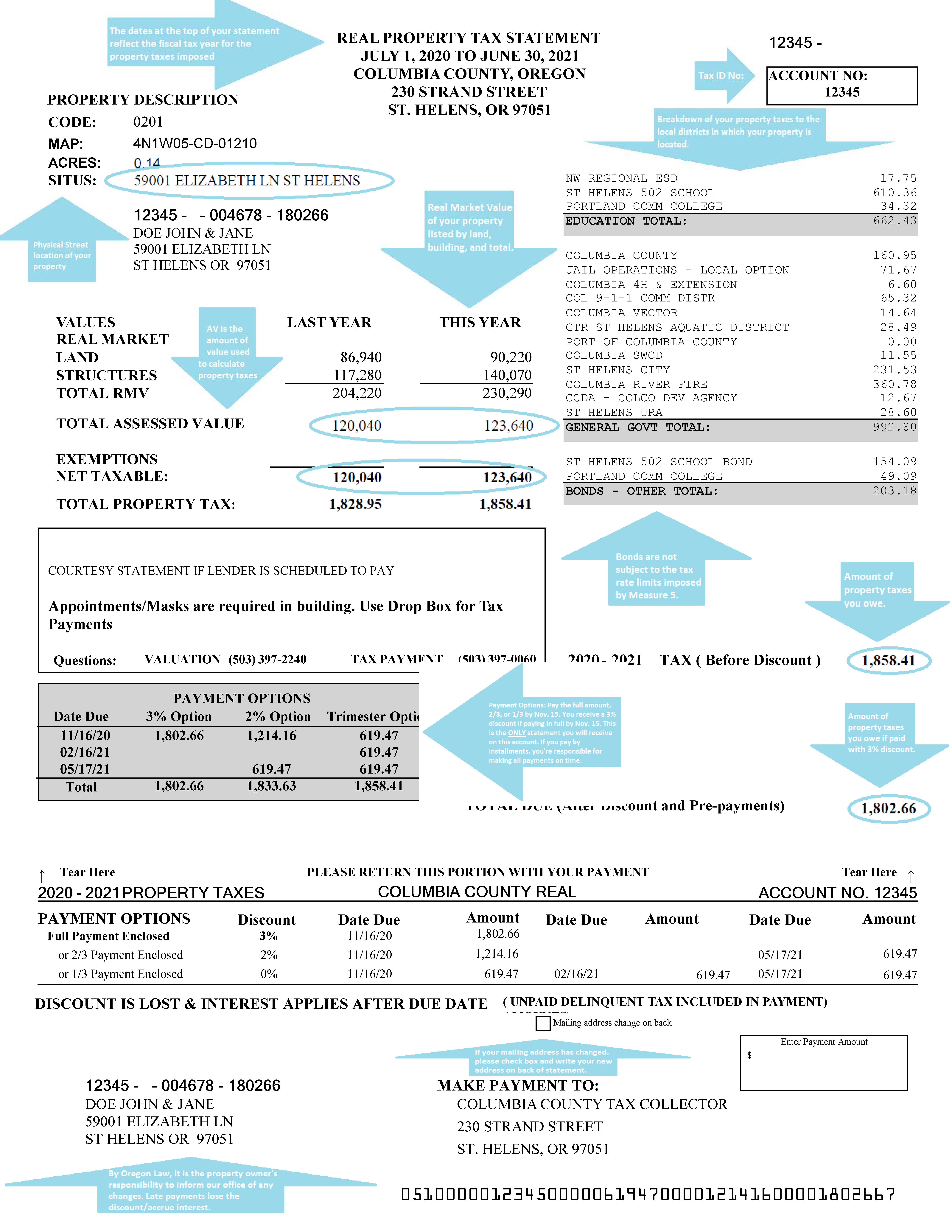

Failure to pay estimated taxes when due may result in interest being charged from. Oregon Payroll Reporting System Payment due dates Your payroll tax payments are due on the last day of the month following the end of the quarter. Please refer to the chart below or the backside of your tax statement to keep aware of the dates.

Quarter Period Covered Due Date 1st 1-1 to. The 2021 tax deadline to file City of Oregon returns is April 18 2022. April 18 2022 2nd payment.

Oregon State Taxes Due Date will sometimes glitch and take you a long time to try different solutions. The CAT is applied to taxable Oregon commercial activity in excess of 1 million. 4 Payments are due on the last day of the 4th 7th and 10th months of the tax year and the first month immediately following the end of the tax year.

Quarterly tax payments could help lessen impact of tax. 2 If the period. 2022 Tax Rates The tax rates for Tax Schedule III are as follows.

If the period covered is less than four months only one payment is required. Enter the month day and year for the. April 15 2022 Last date to file.

Annual domestic employers payments. Due Dates for 2021 - 2022 Tax Payments November 15th Monday 2021 February 15th Tuesday 2022 May 16th Monday 2022 Three payment options. 5 Due dates of payments for short.

LoginAsk is here to help you access Oregon State Taxes Due Date quickly and. It is equal to 100 percent of the estimated tax and is payable on the due date of the return. There are four due dates each year.

An official website of the State of Oregon Heres how you know. The tax is computed as 250 plus 057 percent of taxable Oregon commercial activity of more than 1. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950 Form OR-19-V instructions Tax year.

Quarterly Use Fuel Seller and User Tax Reports must be received by the department on or before the due dates according to the following schedule. Choose to pay directly from your bank. When can I file Oregon State Taxes.

The first quarter 2020 Form OR-STT-1 return and payment due date is not postponed and payments are still due April 30 2021. This includes payment of your 2021 tax liability. Rule 1 If the federal tax due is less than 1000 at the end of.

Mail the payment and voucher to. In addition to the payment. Oregon Department of Revenue Payments.

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Oregon Landlord Tenant Law Avail

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Understanding My Bill Nw Natural

Oregon Payroll Tax Form Fill Out Printable Pdf Forms Online

Even During Pandemic Oregon State Quarterly Taxes Still Due Kxl

Update On Portland And Oregon Tax Deadlines Isler Northwest Llc

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Property Tax Payment Faqs Multnomah County

Estimated Income Tax Payments For 2022 And 2023 Pay Online

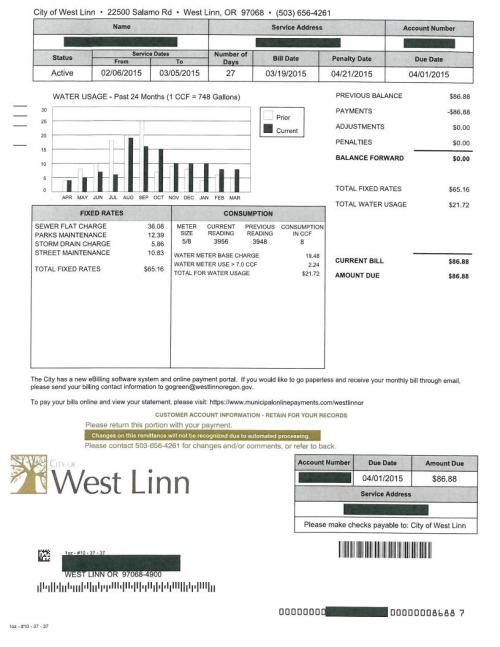

Paying Your City Services Bill A K A Utility Bill City Of West Linn Oregon Official Website

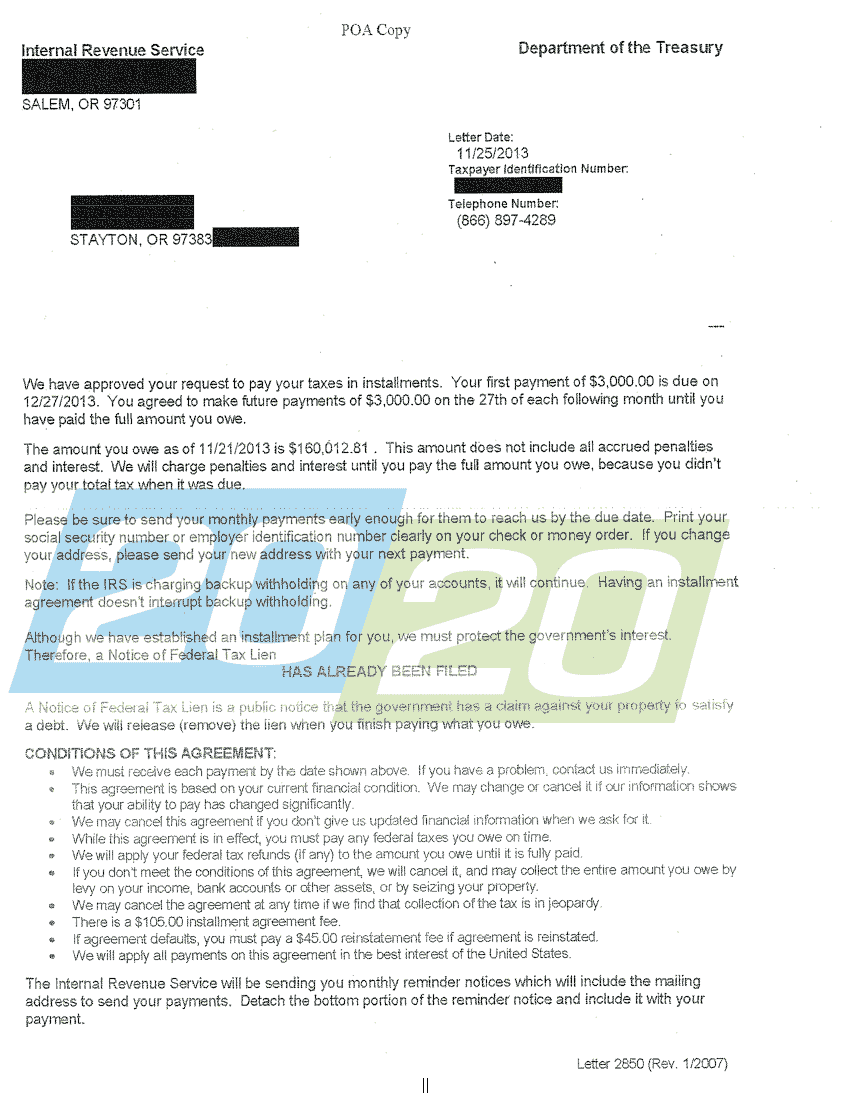

Irs Accepts Installment Agreement In Stayton Or 20 20 Tax Resolution

Or Or Wr 2018 2022 Fill Out Tax Template Online Us Legal Forms

Egov Oregon Gov Dor Pertax 101 154 07

Oregon Income Tax Calculator Smartasset

John A Warekois Cpa Llc Tax Day Now July 15 Treasury Irs Extend Filing Deadline And Federal Tax Payments Regardless Of Amount Owed As Of 3 25 2020 Oregon Has Extended The Filing

Here S The Kicker Oregonians To Receive A Tax Rebate In 2018 Opb

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder